Transferring Funds to India: Navigating Western Union's Landscape

The rhythmic clicking of a keyboard, the soft glow of a screen illuminating a focused face – the digital age has redefined how we connect with loved ones across borders. Sending money home to India has become a vital lifeline for many, a tangible expression of support and connection. But navigating the intricate world of international money transfers can feel daunting, a complex tapestry of fees, exchange rates, and transfer speeds. Understanding the nuances of Western Union's money transfer rates to India is essential for making informed decisions and ensuring your hard-earned money reaches its destination efficiently.

Western Union, a name synonymous with global money transfers, has long been a prominent player in facilitating cross-border transactions. Their network spans across continents, connecting individuals and families separated by geographical boundaries. For those sending money to India, Western Union offers a range of options, each with its own set of costs and transfer speeds. Deciphering these options and understanding the associated Western Union India transfer costs is the first step in navigating this financial landscape.

Historically, sending money abroad was a cumbersome process, often involving lengthy bank procedures and significant delays. Western Union emerged as a pioneer, streamlining the process and making it significantly easier to transfer funds internationally. The evolution of Western Union's services, particularly in the context of India money transfer rates, reflects the changing dynamics of global finance and the increasing demand for efficient and accessible transfer methods.

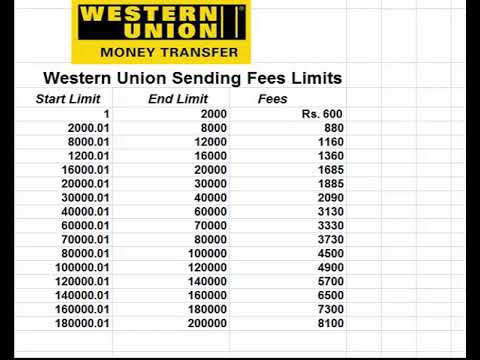

The significance of understanding Western Union's fees for sending money to India cannot be overstated. The cost of transferring funds can significantly impact the amount of money that ultimately reaches the recipient. A seemingly small difference in fees or exchange rates can translate into a substantial difference in the final amount received, particularly for larger transfers. Therefore, meticulous research and comparison of Western Union's pricing structure with other money transfer providers are crucial for optimizing your transfer and maximizing the value received by your loved ones in India.

One of the primary challenges associated with international money transfers is the fluctuating nature of exchange rates. The rupee-dollar exchange rate, for instance, can fluctuate significantly, impacting the ultimate amount received in rupees. Western Union's exchange rates, often different from the mid-market rate, contribute to the overall cost of the transfer. Understanding how these rates are determined and how they compare to other providers is crucial for making informed decisions.

While specific examples of transfers would necessitate real-time data due to fluctuating exchange rates, let's consider hypothetical scenarios. Sending $1000 via Western Union might incur fees ranging from $5 to $50 depending on the chosen transfer method (online, in-person, etc.) and delivery speed. Furthermore, the exchange rate applied by Western Union will determine the final amount received in rupees. Comparing these costs with other providers like MoneyGram or Remitly is a critical step.

For individuals utilizing Western Union to send money to India, several best practices can enhance the transfer experience: compare fees and exchange rates across different providers, consider the urgency of the transfer and choose the appropriate delivery speed, verify the recipient's details meticulously to avoid errors, track the transfer status regularly, and retain transaction receipts for future reference.

Advantages and Disadvantages of Using Western Union to Send Money to India

| Advantages | Disadvantages |

|---|---|

| Wide network and accessibility | Potentially higher fees compared to other services |

| Variety of transfer and delivery options | Exchange rates may not be as favorable as the mid-market rate |

| Established brand and reputation | Transfer speeds can vary depending on the chosen method |

Frequently Asked Questions

How can I find the current Western Union money transfer rates to India? Check the Western Union website or app for real-time rates.

What are the different ways to send money to India via Western Union? Options typically include online transfers, mobile app transfers, and in-person transfers at agent locations.

How long does it take for a Western Union transfer to reach India? Transfer times can vary from minutes to several days, depending on the chosen method.

What documents do I need to send money through Western Union? Valid identification may be required, especially for larger transfers.

Can I cancel a Western Union transfer? Cancellation policies vary, so it's best to contact Western Union directly.

How can I track my Western Union transfer? Use the tracking feature on the website or app with your Money Transfer Control Number (MTCN).

What are the fees for sending money to India via Western Union's mobile app? Fee information can be found on the Western Union app or website.

What are the limits on how much I can send to India through Western Union? Transfer limits may vary based on regulations and individual account status.

Tips for optimizing your transfers include comparing fees and exchange rates meticulously across different services, choosing the most efficient transfer method based on urgency and cost-effectiveness, and staying informed about any ongoing promotions or discounts offered by Western Union.

In conclusion, navigating the intricacies of Western Union's money transfer rates to India requires careful consideration and informed decision-making. By understanding the various factors that influence the cost of a transfer, from fees to exchange rates, individuals can ensure their funds reach their loved ones in India efficiently and effectively. Comparing Western Union’s offerings with other money transfer services, staying abreast of current exchange rates, and utilizing online resources can empower individuals to make the most financially sound decisions. The ability to transfer funds across borders is a testament to our interconnected world, a vital thread in the fabric of global communities. By making informed choices and leveraging the available resources, we can strengthen these connections and ensure our support reaches those who matter most.

Smooth sailing cummins marine exhaust elbows guide

Decoding the ppg automotive paint universe

Transform struggling franchises top madden 23 rebuilding projects