Need to Wire Money Abroad? A Look at Wells Fargo International Wires

Ever found yourself needing to send money across borders? Whether it's for family support, a business transaction, or that dream vacation property, moving money internationally is a crucial part of our interconnected world. Wells Fargo offers international wire transfer services, allowing customers to send funds to various countries. But navigating the world of international finance can be daunting. Let's dive into the details of Wells Fargo international wires, exploring the process, fees, and everything in between.

Sending money abroad isn't as simple as handing cash across a counter. It involves a complex network of banks, regulations, and security protocols. With Wells Fargo's international wire service, you can electronically transfer funds to recipients in other countries. This involves providing specific recipient information, such as their bank details and SWIFT code, to ensure the money reaches the correct destination.

Understanding the intricacies of Wells Fargo's international wire transfers can save you time, money, and potential headaches. From knowing the necessary documentation to understanding the associated fees, being prepared is key. So, what do you need to know before initiating a Wells Fargo international wire transfer? Let's break it down.

One of the first things to consider is the cost. Wells Fargo charges fees for both incoming and outgoing international wire transfers. These fees can vary depending on factors such as the destination country and the amount being transferred. It's important to factor these costs into your budget when planning an international money transfer. Beyond fees, there are exchange rates to consider. Wells Fargo uses its own exchange rates for international wire transfers, which can differ from the mid-market rate you might see online.

Timing is another crucial aspect. While Wells Fargo strives to process international wire transfers quickly, the actual time it takes for the funds to reach the recipient can vary. Factors such as the destination country's banking system and any intermediary banks involved can influence the delivery time. Being aware of these potential delays can help you manage expectations and avoid any surprises. So, let's explore the specifics of initiating a Wells Fargo international wire transfer and the key considerations to keep in mind.

Historically, international money transfers were a complex and time-consuming process. Modern banking systems, including Wells Fargo's international wire service, have streamlined this process significantly. The emergence of SWIFT codes, which uniquely identify banks worldwide, has further enhanced the efficiency and security of international transfers. Wells Fargo's participation in this global network allows for relatively swift and secure transfer of funds across borders.

The importance of Wells Fargo international wires lies in their ability to facilitate global commerce and personal transactions. They enable businesses to pay international suppliers, individuals to support family members abroad, and travelers to access funds in different countries. These transfers are essential for a globalized economy and personal connectivity across borders.

A key issue related to Wells Fargo and other banks that offer international wire transfer services is transparency regarding fees and exchange rates. Customers need clear and readily accessible information about the total cost of their transfer, including both fees and the exchange rate markup. Being aware of these costs upfront is crucial for informed decision-making.

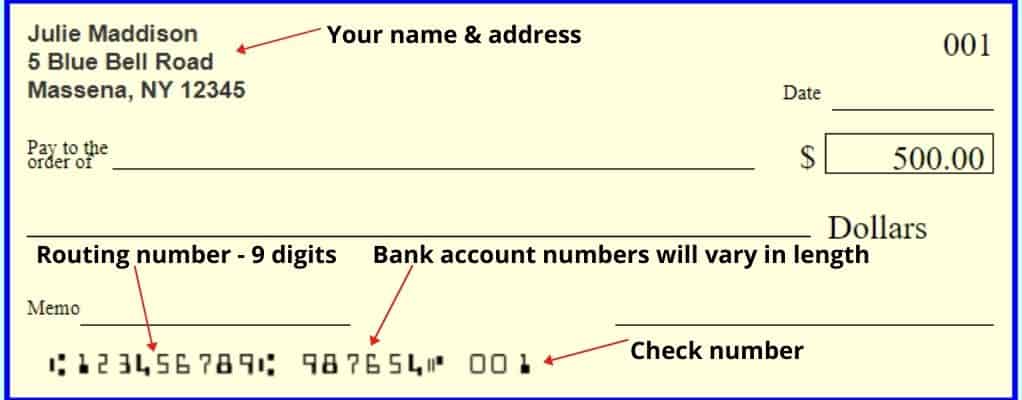

Before initiating a transfer with Wells Fargo, gather the recipient's full name, address, bank name and address, account number, and SWIFT code. This information is essential for accurately directing the funds. Contact Wells Fargo directly for the most up-to-date information about eligible countries and any specific requirements.

Three benefits of using Wells Fargo for international wires include: 1) Established network: Wells Fargo has a large network of correspondent banks worldwide, facilitating smoother transfers. 2) Online convenience: Many international transfers can be initiated online, saving time and effort. 3) Customer support: Wells Fargo offers customer service to assist with any questions or issues related to international wires.

Advantages and Disadvantages of Wells Fargo International Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Established Network | Potential Fees |

| Online Convenience | Exchange Rate Markups |

| Customer Support | Transfer Time Variations |

FAQ: What is a SWIFT code? A SWIFT code is an international bank identifier used for wire transfers.

FAQ: How long does a Wells Fargo international wire take? Transfer times vary, typically 1-5 business days.

FAQ: Can I track my Wells Fargo international wire? Yes, tracking is often available.

FAQ: What currencies are supported? Wells Fargo supports transfers in various currencies. Contact them for specific details.

FAQ: What are the fees for an international wire transfer? Fees vary depending on factors like the destination country.

FAQ: What information do I need to send an international wire? You'll need the recipient's bank details and SWIFT code.

FAQ: Can I cancel an international wire transfer? Cancellation possibilities depend on the transfer's status. Contact Wells Fargo immediately if you need to cancel.

FAQ: What should I do if my Wells Fargo international wire is delayed? Contact customer support for assistance.

Tip: Double-check all recipient information to avoid errors and delays.

In conclusion, navigating the world of international money transfers requires careful consideration. Wells Fargo's international wire service offers a way to send funds across borders, but understanding the associated fees, processes, and potential challenges is crucial. By being prepared and informed, you can make your international money transfers smoother and more efficient. Remember to factor in transfer times, confirm all recipient details, and contact Wells Fargo's customer support with any questions or concerns. Staying informed about international transfer best practices and utilizing available resources can help you manage your international finances effectively.

Google zero gravity unit truth or sci fi

Santa barbara county rainfall a deep dive

Upgrade your bathroom exploring tiled walk in shower designs with seats