Navigating Your Healthcare Journey with Humana Group Medicare PPO Plans

Are you seeking a healthcare solution that offers flexibility and comprehensive coverage? For many nearing retirement, navigating the Medicare landscape can feel overwhelming. Understanding the nuances of different plans is crucial for making informed decisions about your health and well-being. This article delves into the world of Humana Group Medicare PPO plans, providing you with the knowledge you need to determine if this type of coverage aligns with your individual needs.

Humana Group Medicare PPO plans are designed to provide access to a broad network of healthcare providers, offering individuals the freedom to choose their doctors and hospitals. Unlike HMO plans, PPOs generally don't require referrals to see specialists, which can streamline the process of receiving specialized care. These plans offer a balance between choice and predictable costs, making them a popular option for those seeking greater control over their healthcare decisions.

The specifics of Humana's Group Medicare PPO offerings can vary depending on factors such as location and employer group affiliation. It's essential to carefully review the plan details specific to your situation to fully understand coverage, costs, and network limitations. Comparing different plans and considering your individual health needs will help ensure you select the best option for you.

Humana has a long history of providing health insurance coverage. Their presence in the Medicare market reflects their commitment to serving the needs of older adults. Group Medicare PPO plans are an important part of their portfolio, catering specifically to those individuals enrolled in group coverage through their former employer or other qualifying organization.

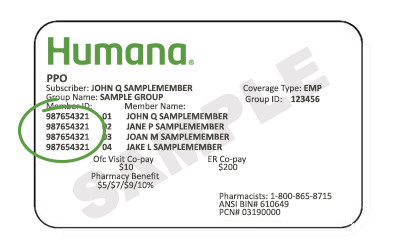

One of the primary issues surrounding any Medicare plan, including Humana's Group Medicare PPO, is understanding the cost structure. Premiums, deductibles, copays, and coinsurance can all contribute to the overall cost of healthcare. It’s essential to carefully evaluate these factors to avoid unexpected expenses and ensure the plan fits within your budget. Comparing out-of-pocket maximums between different plans is also a vital step in the decision-making process. Let's explore some of the benefits these plans offer.

A key advantage of a Humana Group Medicare PPO is the flexibility in choosing providers. You are not limited to a narrow network and can typically see any doctor or hospital that accepts Medicare, although staying within the plan's network often results in lower out-of-pocket costs. This freedom of choice can be particularly important for those who have established relationships with specific healthcare professionals.

Another benefit is the streamlined access to specialists. Unlike HMO plans, which typically require referrals from a primary care physician, PPOs allow you to see specialists directly. This can be particularly valuable when dealing with time-sensitive health issues or when seeking specialized care.

Lastly, many Humana Group Medicare PPO plans offer coverage for prescription drugs. This bundled coverage can simplify healthcare management by combining medical and prescription drug benefits under one plan. It's crucial, however, to review the plan's formulary to ensure your medications are covered.

Advantages and Disadvantages of Humana Group Medicare PPO Plans

| Advantages | Disadvantages |

|---|---|

| Flexibility in choosing providers | Potentially higher costs for out-of-network care |

| Access to specialists without referrals | May require more paperwork for out-of-network claims |

| Often includes prescription drug coverage | Plan options may be limited depending on employer group |

Navigating the complexities of Medicare can be challenging. For a deeper dive into understanding Medicare options, resources like Medicare.gov and the Humana website can provide valuable information.

In conclusion, choosing the right Medicare plan is a significant decision. Humana Group Medicare PPO plans offer a valuable balance of flexibility and coverage, making them a compelling option for many individuals. By carefully weighing the benefits, costs, and specific features of these plans, you can make an informed choice that empowers you to take control of your healthcare journey and prioritize your well-being. Remember to compare different plan options, consider your individual health needs, and consult with a licensed insurance agent to ensure you select the best coverage for your unique circumstances. Taking the time to thoroughly research your options is an investment in your health and future peace of mind.

Effortless banking exploring sterling savings bank online

Sizzling indoors the joy of cast iron electric grilling

Decoding relay symbols circuit speak

.png?VersionId=JqYCndsKVlMZ2P_2EywHCm0arTjKZg4w)