Navigating Healthcare: AARP Supplemental Insurance for Seniors

As we age, healthcare needs evolve, and navigating the complexities of Medicare can be challenging. For seniors seeking comprehensive coverage, AARP, in collaboration with UnitedHealthcare, offers supplemental health insurance plans designed to address the gaps left by original Medicare. These plans, also known as Medigap, provide additional financial protection against out-of-pocket expenses, offering peace of mind and financial stability during retirement.

The rising cost of healthcare is a significant concern for many retirees. Original Medicare, while vital, doesn't cover all medical expenses, leaving seniors potentially vulnerable to substantial out-of-pocket costs. This is where AARP supplemental plans come into play, offering a safety net to help manage these expenses. Understanding these plans is crucial for informed decision-making about healthcare in retirement.

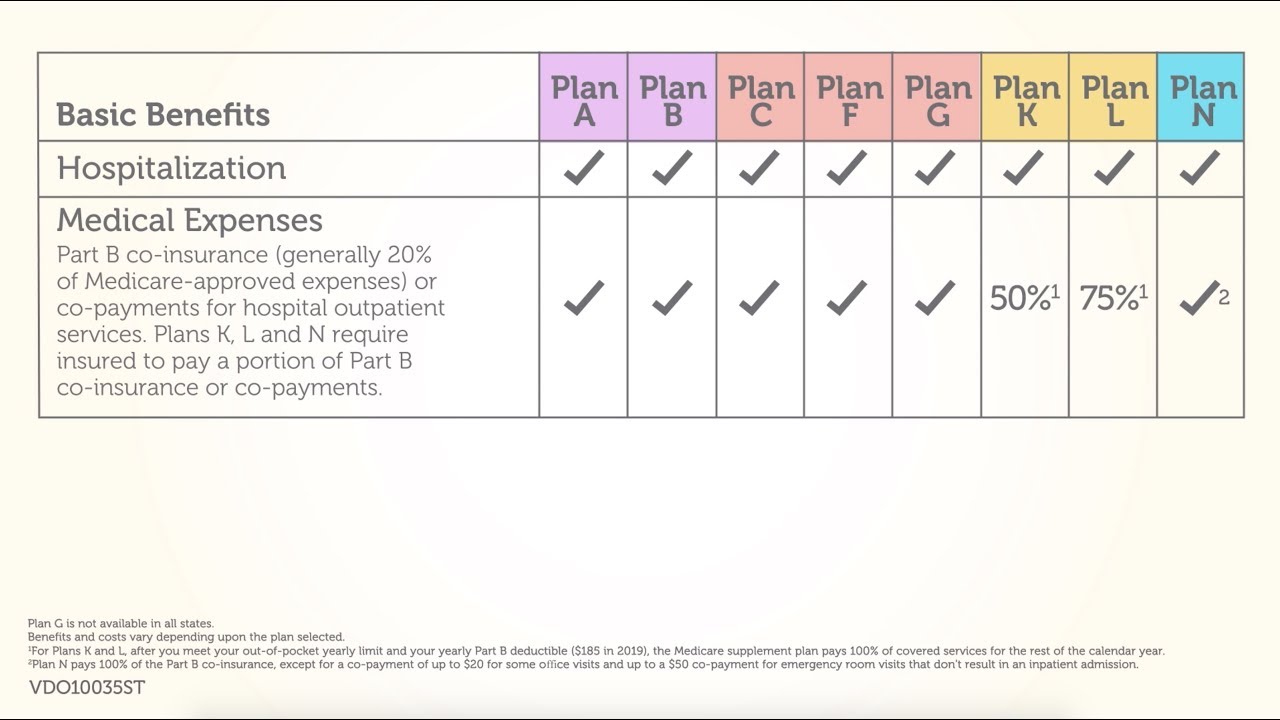

AARP health insurance plans for seniors are designed to complement original Medicare (Parts A and B). They help cover costs like copayments, coinsurance, and deductibles, which Medicare doesn't fully cover. These supplemental plans are standardized by the government, meaning benefits are consistent across different insurance providers offering the same plan letter (Plan A, Plan G, etc.). This standardization simplifies comparison shopping, allowing seniors to focus on finding the plan that best suits their budget and healthcare needs.

The history of Medigap plans, including those offered through AARP/UnitedHealthcare, is rooted in the need to address the gaps in original Medicare coverage. Over time, these plans have evolved to offer various levels of coverage, reflecting changes in the healthcare landscape. Choosing an AARP supplemental health insurance plan requires careful consideration of individual health status, budget, and anticipated medical expenses.

AARP’s role in providing access to these supplemental plans is significant. As a trusted organization for seniors, AARP facilitates access to insurance options designed to meet the specific needs of older adults. These plans provide financial security by reducing out-of-pocket healthcare expenses, allowing seniors to better manage their budgets and focus on their well-being. Selecting the right AARP Medigap plan can make a substantial difference in managing healthcare costs throughout retirement.

For instance, if a senior undergoes a hospital stay, original Medicare might cover a portion of the expenses, but the remaining costs, such as copayments and deductibles, can be significant. An AARP supplemental plan can help cover these remaining costs, reducing the financial burden on the retiree.

There are several types of AARP/UnitedHealthcare supplement plans available to seniors, each identified by a letter (Plan A, Plan G, Plan N, etc.). Plan G, for example, generally covers most out-of-pocket expenses, except for the Part B deductible. Plan N offers similar coverage but with some cost-sharing for doctor visits and emergency room care.

Advantages and Disadvantages of AARP Supplemental Plans

| Advantages | Disadvantages |

|---|---|

| Predictable healthcare costs | Monthly premiums |

| Reduced out-of-pocket expenses | Might not cover all medical expenses |

| Peace of mind and financial security | Can be complex to choose the right plan |

Frequently Asked Questions:

1. What is the difference between Medicare Supplement Plan G and Plan N?

(General answer comparing coverage and costs)

2. How much do AARP supplemental plans cost?

(General answer about premium variations)

3. How do I enroll in an AARP Medigap plan?

(General answer about the enrollment process)

4. Can I switch AARP supplemental plans?

(General answer about changing plans)

5. Are there waiting periods for coverage?

(General answer about pre-existing conditions)

6. What is not covered by AARP supplemental plans?

(General answer about exclusions)

7. Where can I find more information about AARP health insurance plans?

(Refer to AARP's website)

8. How do I contact AARP for questions about supplemental plans?

(Provide general contact information)

Tips and tricks for navigating AARP supplemental plans include comparing plan benefits and premiums, understanding your healthcare needs, and considering your budget. Consulting with an insurance broker specializing in Medicare can also be beneficial.

In conclusion, AARP supplemental health insurance plans provide a crucial safety net for seniors navigating the complexities of Medicare. By helping to cover out-of-pocket expenses, these plans offer financial security and peace of mind. Choosing the right plan requires careful consideration of individual needs, budget, and health status. While there are costs associated with supplemental plans, the benefits of predictable healthcare expenses and reduced financial burden can be invaluable. Taking the time to research and compare AARP supplemental health insurance options empowers seniors to make informed decisions about their healthcare, ensuring financial stability and well-being throughout retirement. Reach out to AARP or a qualified insurance advisor to learn more about the plan that best fits your needs and embark on a healthier, more secure future.

Unlocking your boats story decoding the hull number

Unlock your happy place book power

Conquering the 58 bolt nut size mastery for frugal fixers