Decoding the Rights Issue Offer Letter

Imagine a secret invitation to boost your stake in a company you already believe in. That's essentially what a rights issue offer letter represents. This document, crucial for existing shareholders, grants them the preemptive right to purchase additional shares, often at a discounted price. It's a powerful tool in the world of corporate finance, offering both opportunities and complexities.

Navigating the intricacies of a rights issue offer letter requires a keen understanding of its components and implications. This document outlines the terms and conditions of the rights offering, including the subscription price, the ratio of new shares offered for existing shares, and the deadline for accepting the offer. Deciphering these details empowers shareholders to make informed decisions about their investment.

The issuance of rights has a long history, dating back to the early days of joint-stock companies. It’s a mechanism designed to protect existing shareholders from dilution of their ownership when new shares are issued. Without the right to subscribe to new shares proportionally, existing shareholders could see their percentage ownership decrease, potentially impacting their voting rights and share of future profits.

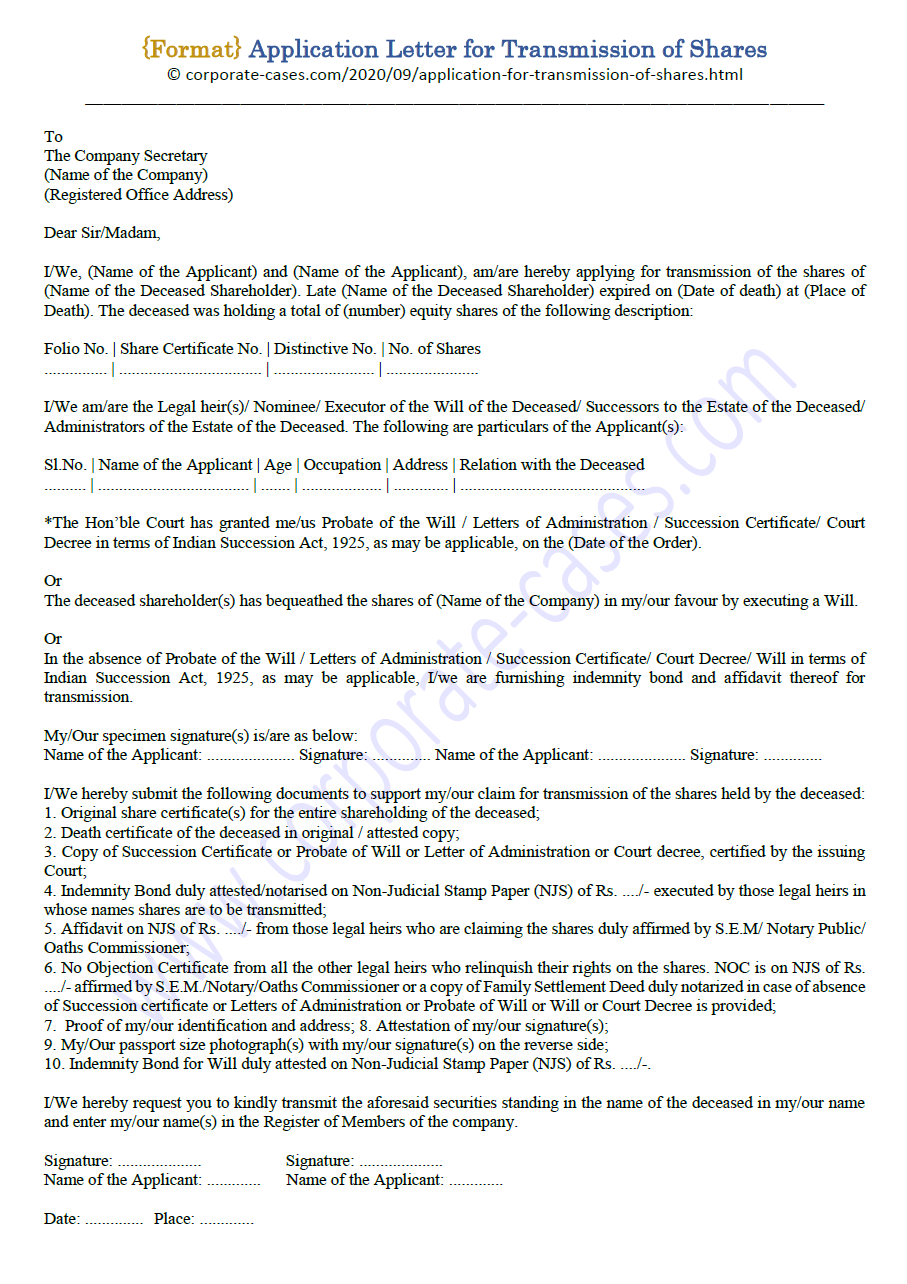

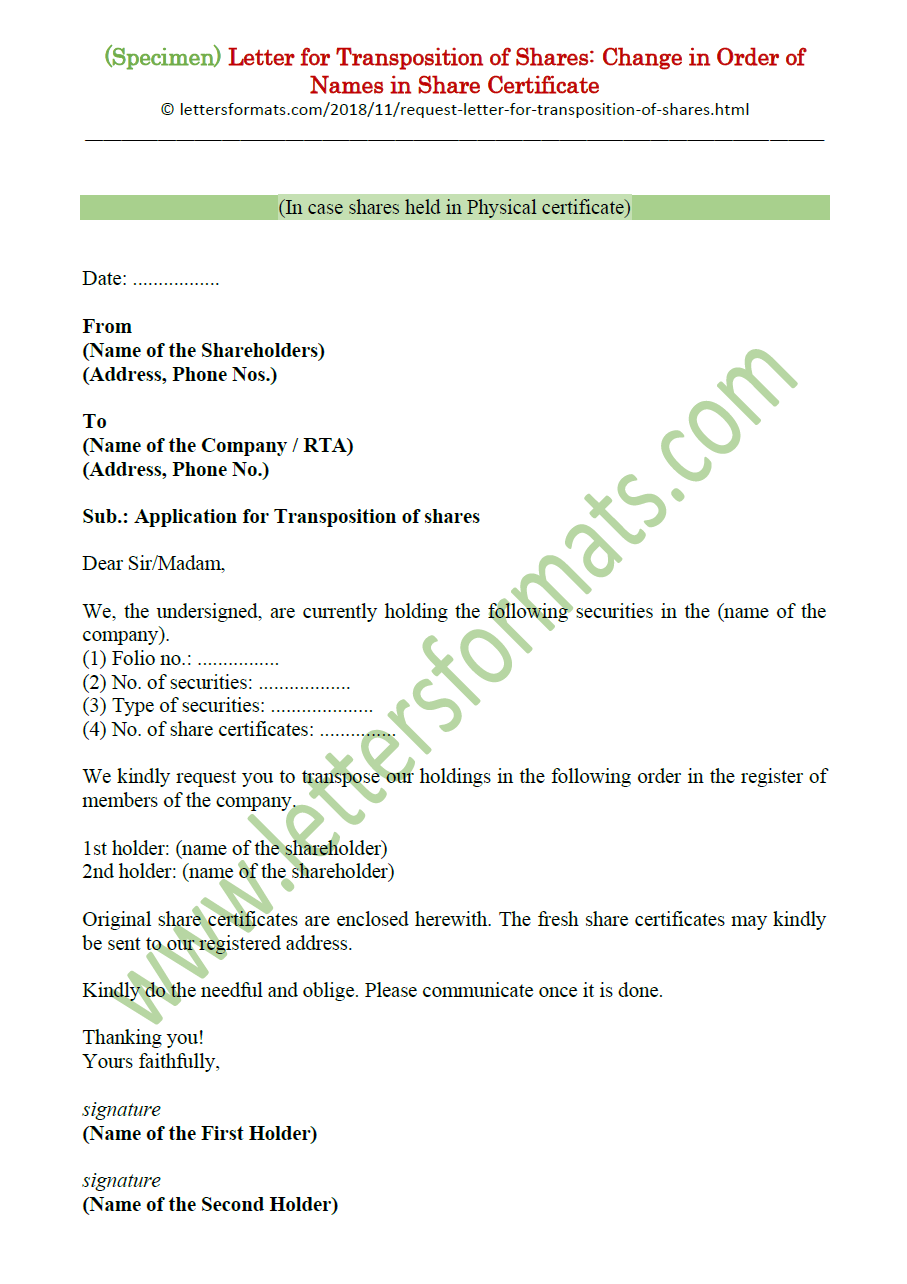

The format of a rights issue offer letter is generally standardized, though specific details may vary depending on jurisdiction and company policy. Key elements typically include details about the company, the reason for the capital raise, the subscription price, the entitlement ratio, the subscription period, and instructions on how to accept or renounce the offer. A clearly structured format ensures clarity and accessibility for shareholders.

One common challenge relates to understanding the implications of exercising or declining the rights. Accepting the offer requires additional capital outlay, while declining could lead to dilution. Evaluating the company's prospects and the terms of the offer is crucial for making a strategic decision. Furthermore, navigating the administrative procedures for accepting the offer can sometimes be complex.

A rights issue proposal, typically communicated via an official document known as the ‘rights issue offer letter’ is the formal proposition presented to shareholders. This proposal encompasses all the crucial details surrounding the offer, allowing shareholders to assess the opportunity and make an informed decision.

A simple example: Imagine owning 100 shares in Company X. The company announces a rights issue with a 1:4 ratio at a subscription price of $10. This means you have the right to buy 25 additional shares (100/4) for $10 each, totaling $250. This allows you to maintain your proportional ownership in the expanded capital structure.

One benefit of a rights issue is maintaining your ownership stake. By subscribing to new shares in proportion to your existing holdings, you prevent dilution. Another advantage is the potential for purchasing shares at a discounted price compared to the market price. Finally, rights issues can signify a company's growth and expansion plans, which can be a positive indicator for future returns.

Before making a decision regarding a rights issue, shareholders should meticulously examine the company's financial performance, the purpose of the capital raise, and the terms of the offer. Understanding these factors will enable a well-informed decision that aligns with the individual investment strategy.

Frequently asked questions include: What are rights shares? What is the entitlement ratio? What is the last date to apply for a rights issue? Can I sell my rights entitlements? What happens if I don't subscribe? How does a rights issue affect share price? What are the tax implications of a rights issue? Where can I find more information about this specific rights issue?

A crucial tip for navigating rights issues is to thoroughly review the rights issue offer letter and all associated documents. Seek professional advice if needed to ensure a full understanding of the implications before making a decision.

In conclusion, the rights issue offer letter is a vital communication tool in the world of corporate finance, bridging the gap between companies seeking to raise capital and their existing shareholders. It’s an opportunity for shareholders to reinforce their commitment and potentially benefit from future growth. By understanding the format, content, and implications of these offers, investors can make informed decisions that align with their investment goals. Taking the time to thoroughly review the offer, understand the company's rationale, and consider your personal financial situation is crucial for maximizing the potential benefits of participating in a rights issue. This process, though seemingly complex, empowers shareholders to actively engage in the growth trajectory of their chosen investments and safeguard their ownership stake. Remember to consult with a financial advisor for personalized advice related to your specific circumstances and investment portfolio.

Amp research running boards troubleshoot

Arkansas ebt food assistance your guide to snap benefits

Handling hydrochloric acid a guide to safe usage