Decoding Medicare Supplement Plan Costs Part B

Medicare. Two syllables that evoke a mix of relief and confusion for those approaching retirement. While the promise of healthcare coverage is welcome, the specifics can feel like navigating a dense forest of acronyms and policy jargon. One particularly thorny area? The cost of Medicare Supplement Plan Part B, often called Medigap.

Understanding the typical price tag associated with these supplemental plans is crucial for effective budgeting and ensuring you’re getting the coverage you need without breaking the bank. This isn't just about numbers on a spreadsheet; it's about your peace of mind and financial well-being in retirement. So, let's dissect the landscape of Medigap Plan B costs and equip you with the knowledge to make informed choices.

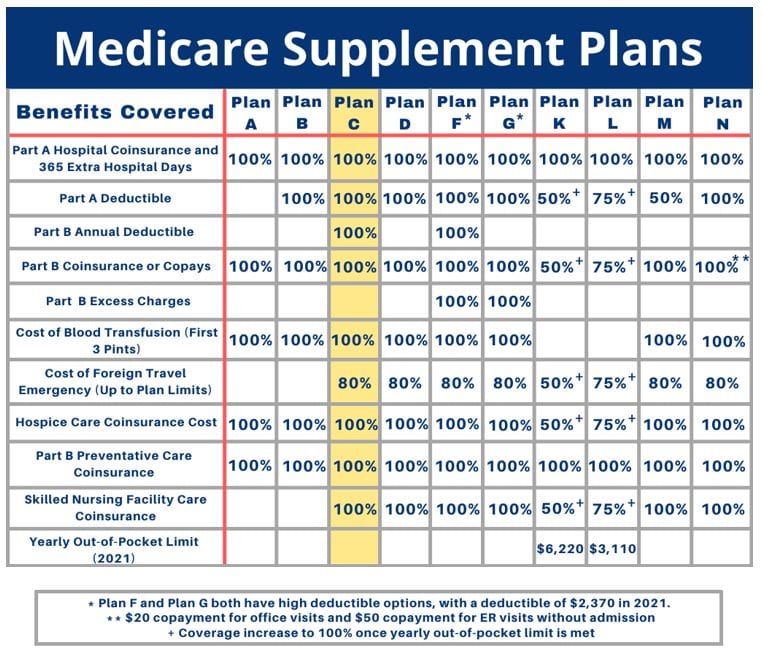

Medicare Supplement plans, designed to fill the gaps left by Original Medicare (Parts A and B), come with a monthly premium. These premiums vary based on the plan you choose (Plan A, B, G, N, etc.), your location, and the insurance company providing the coverage. Pinpointing the "average" cost can be tricky, as these factors create a dynamic pricing environment. However, understanding the range of costs and the variables at play can empower you to navigate the market effectively.

Historically, Medigap plans have evolved alongside Medicare itself, adapting to changing healthcare needs and costs. The standardization of plan letters (A, B, etc.) helped consumers compare options more easily. Today, the importance of understanding Medigap Plan B cost, or any Medigap plan cost, lies in its direct impact on your retirement budget. These plans can significantly reduce out-of-pocket expenses, but the premiums themselves represent a considerable financial commitment.

One key issue regarding Medigap expenses is the potential for sticker shock. Many beneficiaries are surprised by the monthly premium costs, especially if they haven't factored them into their retirement planning. Another challenge is understanding the different plan options and choosing the one that provides the optimal balance of coverage and affordability. This requires careful consideration of your individual healthcare needs and financial situation.

Medicare Supplement Plan B, specifically, covers Part B coinsurance, the Part A deductible, and the first three pints of blood in a transfusion. Plan B does not cover the Part B deductible. Understanding these specifics is essential for comparing Plan B to other Medigap options. For instance, Plan G offers more comprehensive coverage, but comes with a higher premium. Choosing the right plan involves balancing cost with desired coverage levels.

One benefit of having a Medigap plan is predictable healthcare expenses. Knowing your monthly premium allows for better budgeting. Another advantage is access to a wider range of healthcare providers, as you’re not limited to those who accept Medicare assignment. Finally, Medigap plans can provide financial protection against catastrophic healthcare costs, offering peace of mind during unexpected medical events.

Advantages and Disadvantages of Medicare Supplement Plans

| Advantages | Disadvantages |

|---|---|

| Predictable out-of-pocket costs | Monthly premiums can be substantial |

| Greater choice of doctors and hospitals | May not cover all out-of-pocket expenses |

| Protection against high medical bills | Can be complex to compare different plans |

Frequently Asked Questions:

1. What is the average cost of Medigap Plan B? This varies by location and provider.

2. What does Medigap Plan B cover? It covers the Part B coinsurance, Part A deductible, and the first three pints of blood.

3. How do I choose the right Medigap plan? Consider your health needs, budget, and the coverage offered by different plans.

4. When can I enroll in a Medigap plan? The best time is during your Medigap Open Enrollment Period.

5. Can I switch Medigap plans later? Yes, but you may be subject to underwriting and higher premiums.

6. Are there resources available to help me compare Medigap plans? Yes, resources are available online and through State Health Insurance Assistance Programs (SHIPs).

7. What are the most popular Medigap plans? Plans G, N, and F (though F is no longer available to new enrollees) are among the most popular.

8. Should I get a Medigap plan? This depends on your individual circumstances and risk tolerance. Consulting with a financial advisor or SHIP counselor is recommended.

One tip for managing Medigap costs is to compare quotes from multiple insurance companies. Another is to review your plan annually to ensure it still meets your needs and that you're getting the best value.

Navigating the complexities of Medicare Supplement plans, particularly the costs associated with Part B coverage, can feel daunting. However, armed with the right information and a clear understanding of your individual needs, you can make informed decisions that will contribute to your financial security and peace of mind throughout retirement. Remember that resources like the State Health Insurance Assistance Programs (SHIPs) and Medicare.gov are available to provide free, personalized guidance. Don't hesitate to reach out for help. Your health and financial well-being are worth the effort. Take the time to research, compare, and choose the plan that fits your unique situation. This proactive approach will empower you to make the most of your Medicare benefits and enjoy a healthier, more secure retirement.

Unlocking euphoric glide the art of boat drawn surfing

Dead battery no problem enter the heavy duty jump box

The ceos secret spouse unveiled