Decoding AARP Supplemental Insurance for Providers

Ever wondered how AARP supplemental insurance works from a provider's perspective? It's a fascinating landscape, and understanding it can be crucial for healthcare professionals. We're diving deep into this topic, uncovering the nuances and offering practical insights.

AARP, a powerhouse in advocacy for older Americans, offers a range of supplemental insurance plans. These plans, often offered through UnitedHealthcare, aren't your typical Medicare Advantage or Part D plans. They're designed to fill gaps in traditional Medicare coverage, helping seniors manage out-of-pocket expenses like co-pays, deductibles, and coinsurance. For providers, this means navigating a different set of reimbursement procedures and understanding the specifics of each plan.

The history of supplemental Medigap plans, including those offered through AARP/UnitedHealthcare, is rooted in the evolution of Medicare itself. As Medicare evolved, gaps in coverage emerged, leading to the development of supplemental plans to address those gaps and provide more comprehensive coverage for seniors. For providers, this translates to understanding the interplay between Medicare and these supplemental plans.

The importance of AARP supplemental insurance for providers is multi-faceted. It impacts everything from claim submission processes to patient financial responsibility. By understanding these plans, providers can better serve their patients, ensuring smooth and efficient billing practices. This can also lead to improved patient satisfaction and stronger provider-patient relationships.

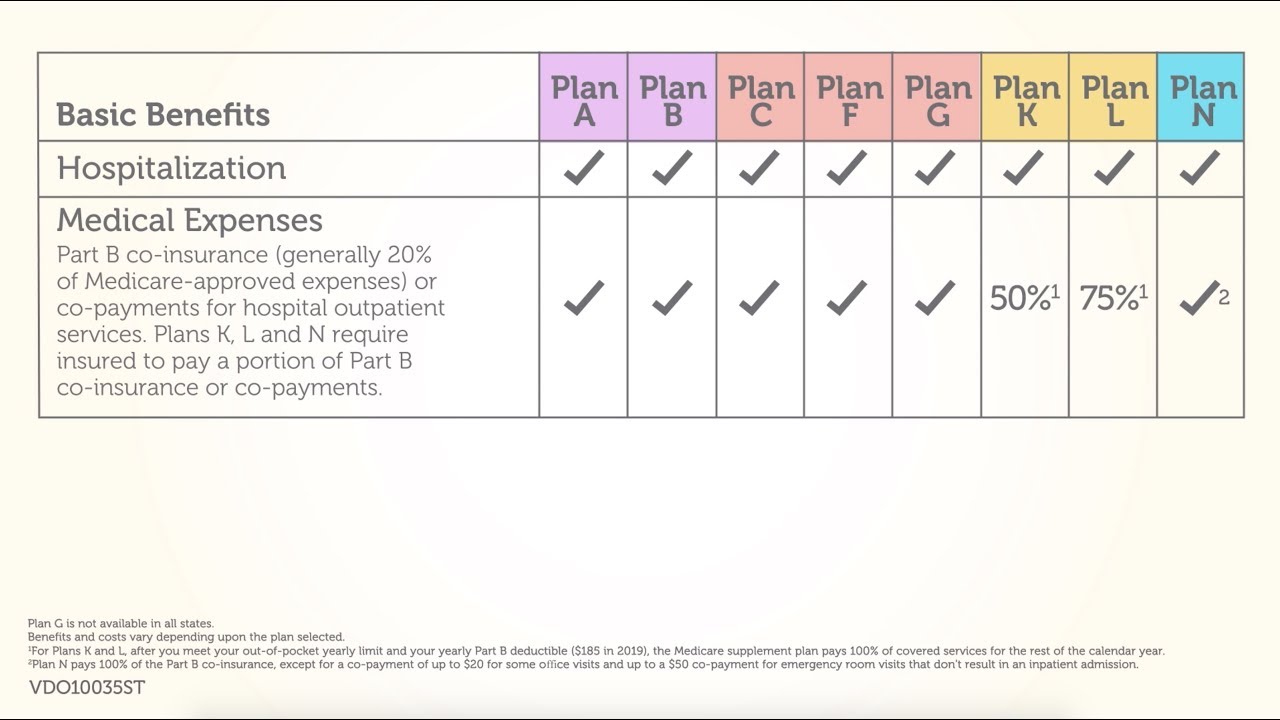

However, there can be challenges. Navigating the different plan types (Plan A, Plan G, etc.), understanding specific coverage details, and keeping up with changes in plan benefits can be time-consuming. Moreover, coordination of benefits between Medicare and the supplemental plan can sometimes present administrative hurdles for healthcare providers.

Let's delve into the types of AARP/UnitedHealthcare supplemental plans. These plans are categorized alphabetically (Plan A, Plan B, etc.) and offer different levels of coverage. For example, Plan F (no longer available to new Medicare beneficiaries) covered the Medicare Part B deductible, while Plan N does not. Understanding these distinctions is crucial for accurate billing and reimbursement.

One benefit of understanding these plans is improved patient communication. Providers can help patients understand their coverage and anticipate out-of-pocket costs, fostering trust and transparency. Another benefit is streamlined billing processes. Knowing the specific coverage details of a patient's AARP plan allows for efficient claim submissions and reduces the risk of denials. Finally, it can contribute to better financial planning for both the patient and the practice.

Providers can optimize their handling of AARP supplemental plans by staying updated on plan changes through UnitedHealthcare's resources. They can also implement training for their billing staff on the nuances of these plans.

Advantages and Disadvantages of AARP Supplemental Insurance for Providers

| Advantages | Disadvantages |

|---|---|

| Simplified billing with reduced patient responsibility. | Increased administrative burden to understand various plans. |

| Improved patient satisfaction due to clear cost expectations. | Potential for claim denials due to incorrect coding or billing. |

A key best practice is verifying patient coverage at each visit. Another is using online portals for efficient claim submission and tracking. Providers should also educate patients about their benefits and responsibilities under their specific AARP plan.

Frequently asked questions include: How do I verify a patient's AARP supplemental insurance? What are the common coding requirements for these plans? Where can I find resources for AARP plan information? How do I handle claim denials? What are the key differences between the various AARP supplemental plans? How can I stay updated on plan changes? What are the common patient questions regarding these plans? How does AARP supplemental insurance impact my practice's revenue cycle?

One helpful tip is to bookmark the UnitedHealthcare provider portal for quick access to plan information. Another is to designate a staff member as the "AARP plan expert" to ensure consistent and accurate handling of these plans.

In conclusion, understanding the intricacies of AARP supplemental insurance is essential for healthcare providers. By staying informed about plan benefits, coverage details, and billing procedures, providers can optimize their revenue cycle, enhance patient satisfaction, and navigate the complexities of these plans effectively. AARP plans play a significant role in the healthcare landscape, impacting both patient access to care and provider reimbursement. Taking proactive steps to understand and manage these plans will contribute to a smoother, more efficient, and ultimately more beneficial experience for both providers and their patients. Investing time in education and utilizing available resources will ultimately benefit your practice and your patients. So, dive in, explore, and become an AARP supplemental insurance pro!

Boat lift installation costs decoding the price tag

Unlocking magic disney drawing for kids

Unlock serenity with sherwin williams coastal plain sw 6192

:max_bytes(150000):strip_icc()/AARP_MedPlans_Logo-48b3d1f020bb4e868337921e7744fdcd.jpg)