Calhoun County Tax Deed Sales: Scoop the Dirt Cheap Deals

Ever dreamt of owning property for pennies on the dollar? Sounds too good to be true, right? Not necessarily. Welcome to the wild, sometimes wacky, world of Calhoun County tax deed sales. These auctions offer a unique opportunity to snag properties at drastically reduced prices, but navigating this landscape requires careful research and a healthy dose of due diligence. Let's dive in.

Calhoun County tax deed sales are essentially public auctions where properties with delinquent property taxes are sold to the highest bidder. Think of it as a real estate clearance sale, where the county aims to recoup unpaid taxes. This process allows the local government to collect revenue and potentially revitalize neglected properties, while savvy investors can find incredible deals. But before you start imagining your beachfront mansion for the price of a used car, there are some important things to understand.

These sales aren't for the faint of heart. While the potential rewards can be substantial, there are inherent risks. You're buying a property "as-is," meaning any liens, code violations, or even squatters become your responsibility. Researching the property's history and conducting thorough due diligence are crucial steps before placing a bid. A seemingly amazing deal can quickly turn into a financial nightmare if you're not prepared.

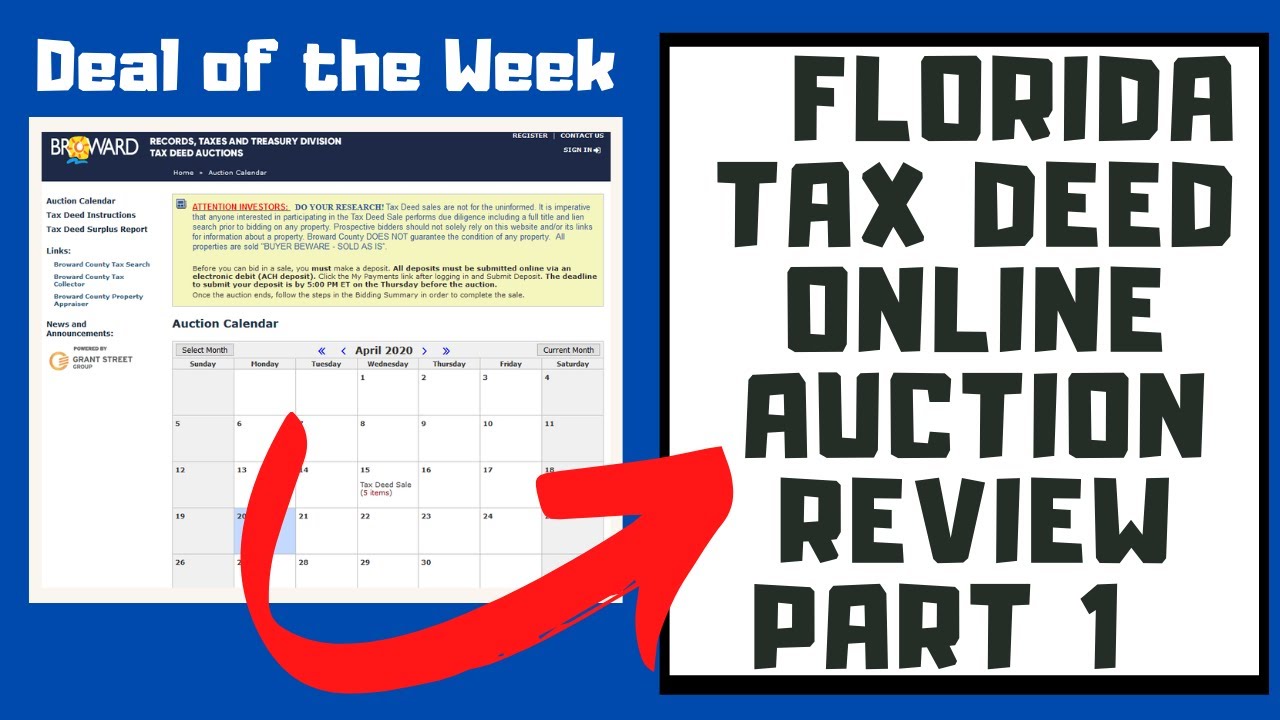

The process generally involves researching available properties, attending the auction, placing your bid, and if successful, navigating the post-sale procedures. Each county has specific rules and regulations governing these sales, so understanding the local laws in Calhoun County is paramount. This includes knowing the required deposit, acceptable payment methods, and the timeline for taking possession of the property.

So, how does one even begin to navigate this complex process? First, find a reliable source for information on upcoming Calhoun County tax deed sales. The county's website or local legal publications are good starting points. Once you've identified potential properties of interest, dig deep into their history. Check for outstanding liens, code violations, and any other potential red flags. Attending pre-auction viewings, if available, can also provide valuable insights into the property's condition.

The history of tax deed sales is tied to the fundamental right of governments to collect taxes to fund public services. When property owners fail to pay their taxes, the government has a mechanism to reclaim those funds and ensure the continued provision of essential services.

One key benefit of the Calhoun County tax deed sale process is the potential for acquiring properties below market value. This creates investment opportunities, particularly for those willing to renovate and resell or rent out the acquired property. Another benefit is that it helps to return blighted properties to productive use, potentially revitalizing neighborhoods and boosting local economies. Lastly, it ensures the local government can recoup lost tax revenue, allowing them to continue funding vital public services.

Advantages and Disadvantages of Calhoun County Tax Deed Sales

| Advantages | Disadvantages |

|---|---|

| Potential for below-market-value purchases | Risk of unknown liens and encumbrances |

| Opportunity to revitalize properties | Responsibility for existing property issues |

| Contributes to local economic growth | Complex and often time-consuming process |

Frequently Asked Questions:

Q: Where can I find information on upcoming Calhoun County tax deed sales? A: Check the county's official website or local legal publications.

Q: What are the payment requirements for Calhoun County tax deed sales? A: This varies, but generally includes a deposit and specific payment methods. Check the county's regulations.

Q: What happens if there are existing liens on a property sold at a tax deed sale? A: The buyer becomes responsible for all existing liens.

Q: Can I inspect the property before bidding? A: Pre-auction viewings may be available. Check with the county.

Q: What are the risks associated with buying a property at a tax deed sale? A: Risks include unknown liens, property damage, and potential legal issues.

Q: What happens if the previous owner tries to reclaim the property? A: Laws vary, but there are specific procedures for reclaiming property after a tax deed sale.

Q: What are the typical closing costs associated with a tax deed sale? A: Closing costs can vary and should be researched beforehand.

Q: Are there any resources available to help me navigate the process? A: Consult with a real estate attorney or tax professional.

In conclusion, Calhoun County tax deed sales present a unique opportunity for investors and homeowners to acquire property at potentially significant discounts. However, the process requires careful research, due diligence, and a clear understanding of the associated risks. By understanding the intricacies of Calhoun County's specific regulations, conducting thorough property research, and seeking professional advice when needed, you can navigate this complex landscape and potentially uncover incredible real estate deals. Remember, the key to success in tax deed sales lies in preparation, knowledge, and a calculated approach. So, do your homework, assess your risk tolerance, and perhaps you'll find your next real estate gem at a fraction of the cost. Take advantage of the resources available, and don't be afraid to seek professional guidance. The potential rewards can be substantial, but informed decision-making is paramount in this exciting and often unpredictable market.

The enduring appeal of sage green exteriors

Dead battery the ultimate guide to portable jump starters

Connecting with fellow josh hutcherson enthusiasts